Investor relations

I. Company activity

Image Power S.A. operates in the video game market, specialising in the production and distribution of games for desktop computers. The company was set up on June 24, 2016 and launched its activity connected to the gaming industry in 2019. In the same year, the company acquired an important investor, PlayWay S.A., leading video game producer and publisher, listed on the Warsaw Stock Exchange.

The company produces, publishes, and markets games. The company’s products will be sold worldwide via the digital distribution model, mainly through the dedicated distribution platform Steam, the largest distributor of PC games in the world. Apart from that, it will also publish games for consoles such as Nintendo Switch, Xbox One and PlayStation 4.

The driving principle of its activity is the production and distribution of several low and medium-budget and low-margin games. The products are created by scattered small teams of developers, which reduces operation risk thanks to optimal reactions to unexpected random events which may occur during project production. The issuer currently has 4 internal and one external team.

II. Company authorities

BOARD

Marcin Zaleński – Chairman of the Board

He has over 20 years of experience in sales in the commercial sector and financial institutions, as well as over 10 years of experience in building and managing sales teams in the financial and investment sectors. He has been on several boards of commercial law companies. At present, he is also Chairman of the Board of Fundusz Stabilnego Rozwoju sp. z.o.o., of which he is the co-creator and shareholder, and its subsidiary Income Capital sp. z o.o., which, in turn, participated in the creation, development and debut on the Newconnect market of the company Movie Games S.A.

SUPERVISORY BOARD

Rafał Janik – Chairman of Supervisory Board

A graduate of the University of Gdańsk. He has been involved in the video game industry since 2017. In 2019, he defended his PhD thesis with distinction, focusing on the efficient market hypothesis and stock recommendations. He has 15 years of experience in data analysis, business consulting, and company valuation. He runs his own investment risk management firm. Author of books and articles devoted to financial markets. Privately, he is an avid climbing and cycling enthusiast.

Robert Żołędziewski – Member of the Supervisory Board

A certified coach and trainer with over 20 years of experience in supporting managers, sales teams, and executive staff. A graduate of the National Film School in Łódź (PWSFTviT), the University of Information Technology and Management, and IAC Institutes. He has trained more than 8,000 professionals in leadership and interpersonal skills. An academic lecturer who combines a passion for cinema with expertise in coaching and management, effectively supporting the growth of people and organizations.

Robert Ogłodziński-Kolman – Member of the Supervisory Board

Since 2012, he has been involved in the gaming industry — working his way from narrative designer to producer and manager. He holds a degree in Journalism and a postgraduate diploma in Law, Economics, and Management from the University of Warsaw. He has over 20 years of experience in economic journalism. He worked at CD Projekt on The Witcher 3 and Cyberpunk 2077, and has collaborated with several Polish indie studios, including Varsaw Games, Walkabout Games, Polyamorous, Fuero Games, and Warhound. Former Head of Studio at Klabater, and co-founder of Longterm Games, Enjoy Studio, and Rune Powered. He has lectured on journalism and game production at institutions such as the University of Warsaw, Łazarski University, and the Warsaw Film School. Since January 2024, he has been leading the Program Planning Department at the Creative Industries Development Center.

Jakub Trzebiński – Supervisory Board Member

In his career he has written about video games for, among others, magazines CD-ACTION, FILM and LADOS, and portals Polygamia.pl , Stopklatka.pl and Muzyka.pl. He has been working for PlayWay S.A. since 2013, as Vice Chairman since 2016. As COO/CMO in PlayWay S.A. he is responsible for the presence of global brands in Car Mechanic Simulator games, production supervision of games created by PlayWay S.A., media contacts and relations, discovering new developer teams, business contacts and company development, among others.

Marlena Wieteska – Supervisory Board Member

Has 15 years of marketing experience in banks (Citibak, Raiffeisen Bank, FMBank – currently Nest Bank), fintechs (CashDirector S.A., Fair Place Finance S.A.), and digital and advertising agencies (Gamfi, Novem, Garden of Words), 7 years of experience in sales, and 8 years of mentoring experience, including pro bono work for Women Leadership in Business Foundation and AIESEC.

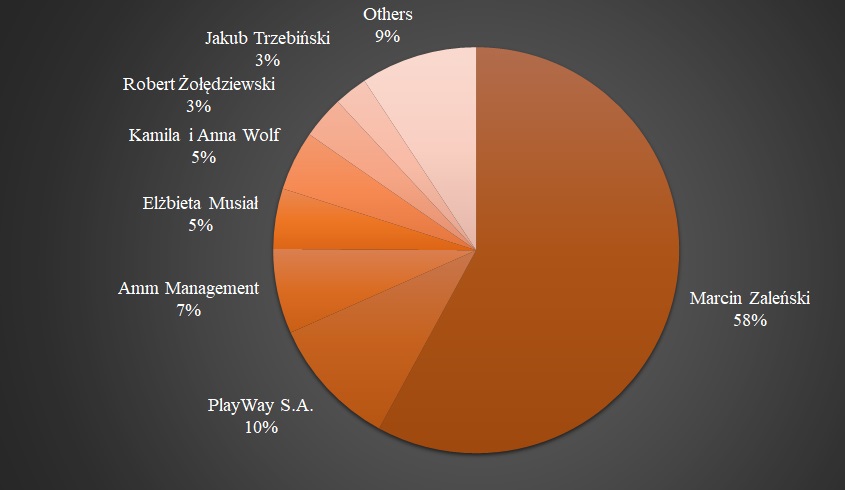

III. Ownership

The ownership structure of the Issuer (shares of initial capital and votes in General Meeting) and the list of shareholders owning at least 2% of shares in initial capital and votes in General Meeting of Shareholders are presented below:

Ownership Structure of Issuer (share of initial capital and votes in General Meeting)

| Shareholder | Number of shares | Number of votes | Share of initial capital | Share of total number of votes |

| Marcin Zaleński | 1 871 577 | 1 871 577 | 57,93 | 57,93 |

| PlayWay S.A. | 336 500 | 336 500 | 10,42 | 10,42 |

| Amm Management | 218 000 | 218 000 | 6,75 | 6,75 |

| Elżbieta Musiał | 155 300 | 155 300 | 4,81 | 4,81 |

| Kamila i Anna Wolf | 153 600 | 153 600 | 4,75 | 4,75 |

| Robert Żołędziewski | 110 000 | 110 000 | 3,40 | 3,40 |

| Jakub Trzebiński | 86 000 | 86 000 | 2,66 | 2,66 |

| Others | 299 887 | 299 887 | 9,28 | 9,28 |

| Total | 3 230 864 | 3 230 864 | 100,00 | 100,00 |

Authorized advisor

ul. Nyska 87/51

50-505 Wrocław

tel: (+48) 71 307 36 24

fax: (+48) 71 719 91 55

email: info@blueoak.pl

www.blueoak.pl

Market animator

Market animator

Plac Unii, Budynek B

ul. Puławska 2

02-566 Warszawa

tel. (+48) 22 330 11 11

www.trigon.pl/